Credits & Savings for Energy-Efficient HVAC Systems in 2023

As we strive toward a more sustainable future, Uncle Sam encourages homeowners to invest in energy-efficient heating and cooling equipment. Tax credits are available to those purchasing and installing new heating and cooling equipment in 2023 that meets specific energy efficiency standards. These tax credits provide a significant financial incentive for homeowners to switch to more energy-efficient equipment. Here’s why you should care and what’s in it for you.

Why Should You Care

First, it’s crucial to discuss why energy-efficient heating and cooling equipment is valuable. Heating and cooling equipment account for a significant portion of your home’s energy consumption. The Department of Energy (DOE) estimates that heating and cooling account for about 48% of the energy use in a typical U.S. home. By upgrading to more energy-efficient equipment, homeowners can significantly reduce their energy consumption and lower utility bills. Energy-efficient equipment also reduces greenhouse gas emissions and helps to combat climate change.

What’s In It For You

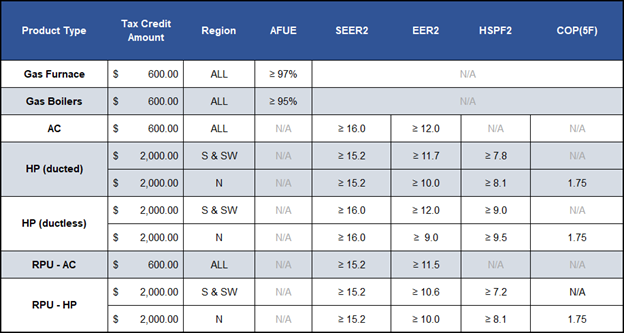

Now let’s talk about what’s in it for you. The 2023 Federal Tax credit for new heating and cooling equipment can provide significant financial savings for homeowners. The tax credit is worth up to 30% of the cost of the equipment, up to a maximum of $2,000. This means that if you purchase and install qualifying equipment that costs less than $10,000, you could receive a tax credit of $2,000. The tax credit is available for primary residences and second homes but not for rental properties.

It’s important to note that not all heating and cooling equipment qualifies for the tax credit. The equipment must meet certain energy efficiency standards for eligibility. For example, central air conditioning systems must have a Seasonal Energy Efficiency Ratio (SEER2) of 16 or higher, and furnaces must have an Annual Fuel Utilization Efficiency (AFUE2) of 97% or higher. Working with a qualified HVAC contractor is essential to ensure that the equipment you are considering meets the eligibility requirements for the tax credit.

In addition to the tax credit, investing in energy-efficient heating and cooling equipment can also increase the value of your home. Energy-efficient upgrades are becoming increasingly popular among homebuyers and can help your home stand out in a competitive real estate market.

In conclusion, the 2023 tax credit for new heating and cooling equipment provides a valuable financial incentive for homeowners to invest in energy-efficient equipment. By upgrading to more energy-efficient equipment, homeowners can significantly reduce their energy consumption, lower their utility bills, and help to combat climate change. To take advantage of this tax credit, call us to ensure that the equipment you are considering meets the eligibility requirements.

*Regions: N (North) NE (Northeast) NW (Northwest) S (South) SE (Southeast) SW ( Southwest)

Sources:

U.S. Department of Energy. (2021). Energy Saver 101 Infographic: Home Heating and Cooling. Retrieved from https://www.energy.gov/energysaver/articles/energy-saver-101-infographic-home-heating-and-cooling

U.S. Department of Energy. (2023). Residential Renewable Energy Tax Credit. Retrieved from >https://www.energy.gov/savings/residential-renewable-energy-tax-credit

Request Service

Why Choose Hager Fox Heating & Air Conditioning?

For Service That Rocks, Call Hager Fox

- Licensed & insured

- Service all brands, including Lennox, Mitsubishi & Kohler

- Free estimates on replacement quotes & service calls

- Background-checked & NATE-certified technicians

- Financing options & instant rebates

- Committed to excellence

- 100% satisfaction guaranteed